Why We Are Different

The failure to identify real drivers of financial performance and risk has had disastrous consequences on the Financial Services industry.

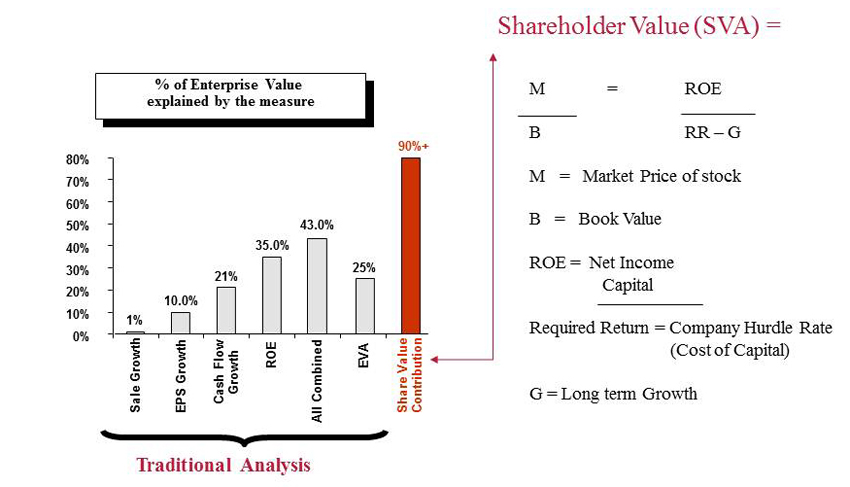

- Conventional measures of financial performance used by securities analysts, financial advisors, and rating agencies to the financial services industry do not work. These measures are past oriented and not forward looking.

- Use trailing M/B and P/E ratios to assess value

- Do not adjust companies’ M/B and P/E ratios to reflect financial and operating leverage considerations when benchmarking comparative financial performance among peer

- Do not allocate capital in proportion to risk contribution by activity so that risk adjusted returns on capital can be compared: within multiline companies and between peer companies

- Industry generally allocates capital based on risk-based capital (RBC or rating agency considerations) – a practice that is not supported by research as having any predictive power

- No attention is directed at firms’ hurdle rates (cost of capital) relative to there net earning spreads – a key component of value creation

These deficiencies explain why Predyct has been making extraordinarily accurate yet contrarian calls years ahead of the market for the last 15 years. This capability can assist corporate decision makers to seize opportunities while avoiding serious calamities.

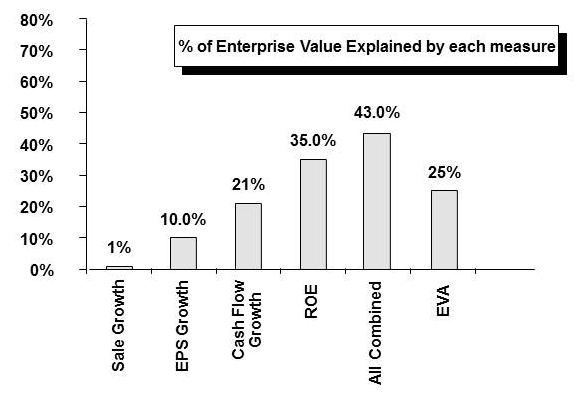

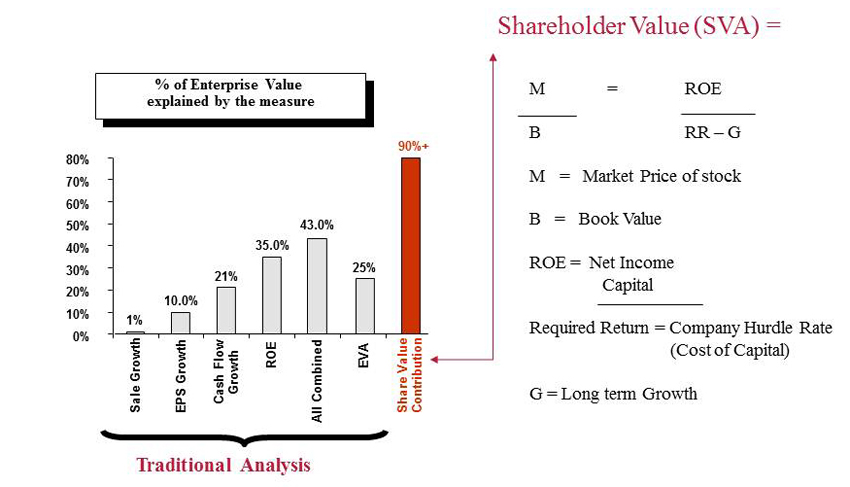

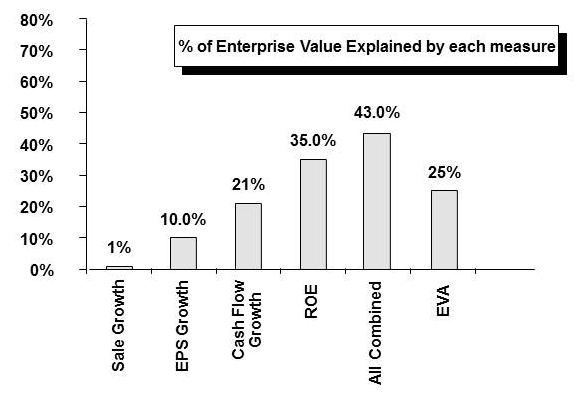

The conventional measures of financial performance provide little information about companies’ shareholder value

Typical measures in use:

- ROE

- Earnings per Share Growth

- Growth of Operating Earnings

- A combination of the above

|

Less typical

|

A far better estimation of shareholder value is achieved when the real drivers of shareholder value are estimated

So why does traditional analysis avoid the application of this SVA framework?

This failure results because the SVA measures for ROE, Required Return and Growth are all dependent on being able to measure:

- Capital Adequacy for the whole company

- The level of capital required to sustain a desired level of risk and rating level

- Capital Allocation

- The allocation of capital within multiline companies in proportion to the risk contribution of their different business and investment activities

- Without the proper allocation of capital in proportion of risk contribution the appropriate return on capital by business activity cannot be observed

These are two of the most complex measures to perform in all finance and risk management. Most firms and analysts either do not know how to make these assessments or do not have the risk technology to perform these tasks.

Further complicating this process is that no one methodology can successfully measure risk. This is because risk presents firms with two very different problems:

- The quantity and allocation of capital required to sustain risk at a desired rating level

AND

- The cost of that capital

These two problems require two unique solutions that must be solved in a consistent framework.

The two solutions:

- Cost of capital is primarily a finance issue and is solved in a shareholder value (finance) framework (SVA):

- CAPM : Capital Asset Pricing Model

- Merton methods

- Modigliani & Miller (M&M)

- APT : Arbitrage Pricing Theory

- Capital allocation is primarily a risk modeling exercise and is solved with stochastic (probabilistic) frameworks

- DFA : Dynamic Financial Analysis

- VaRs : Value at Risk_Simulation

Predyct Analytics is the only firm that solves these two problems in a fully consistent framework that we have named Predyct's Decision Framework (PDF).

Sharholder Value Analysis (SVA)

A forward-looking shareholder value model

- Captures forward looking risk and value observations absent in historical data

- Models each component of SVA framework

- Calculates cost of capital and Embedded Value

- Benchmarks company to peers based on SVA

|

Convergent Decision Point |

Enterprise Risk Model

A rigourously integrated full valuation engine

- Models variability of a firm’s net worth

- Based on VaR Full Valuation simulation technology

- Complete scenario and stress testing capability

- Benchmarking capability

- Parameterized with ten years of data for all assets and liabilities

|

Our platform capabilities can be a “game changer” in the way insurance and asset management companies are evaluated and rated

- Fully integrated risk framework, encompassing insurance, catastrophe, market, and credit risks

- Methodology radically different from conventional techniques (such as risk-based capital (RBC) or rating agency metrics)

- Rigorous capital allocation in proportion to risk contribution of company’s business and investment activities, with the ability to identify activities that create or destroy corporate value

- Analytical ability to reveal often very different picture of firm’s economics and significant performance metrics (key performance indicators)

- Use of predictive risk metrics that identify “emergent” risks often missed by less precise methodologies and go “behind” and “beyond” conventional static ratios

- Consistent methodology uses the same dimensions of risk and risk metrics within an enterprise and across peer companies

- Exceeding risk measurement criteria embodied in all international insurance Solvency regimes- Solvency II, Basel II, FSA, APRA, SARBOX

- Measurement of impact on risk, capital requirements, and profit from catastrophe risk reinsurance

- Mapping rating differences to root causes by drill-down capability to evaluate the financial performance of each business and investment activity

- Assessment of specific causes of its success or failure, not just quality of the firm’s risk and financial strength