Beyond Business Intelligence

Predictive Science for Today's Bottom Line

Beyond Business Intelligence

Predictive Science for Today's Bottom Line

A versatile risk management platform should also provide management with a tool to assess the effectiveness of its business strategies. ERM provides this capability by having a robust scenario- generating capacity that allows its users to test the risk and profitability of each business strategy. We identify the following classes of scenario:

Case Study—Cargo Inc.

Cargo Inc. (Cargo) is a multi-line property and casualty company that writes business on a nationwide basis. Cargo is a real company but the authors have disguised its name and its numbers. Only publicly available information has been used to assess the operations of Cargo.

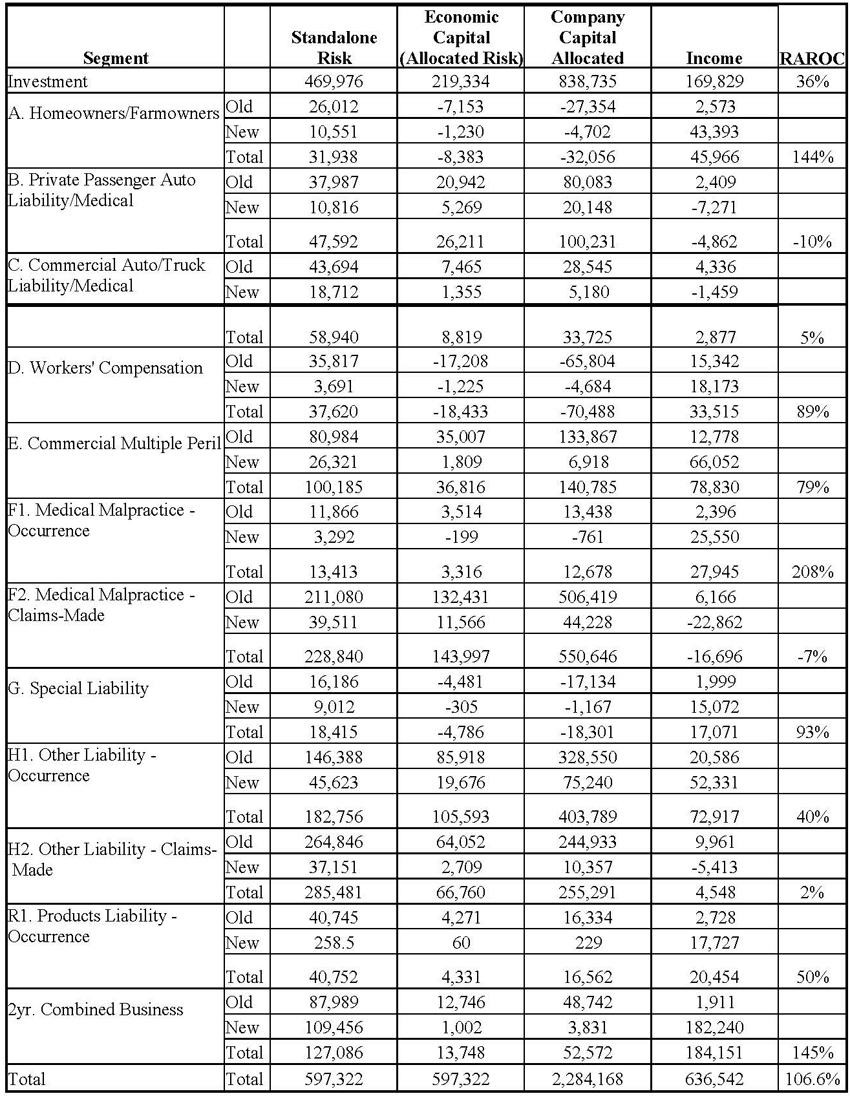

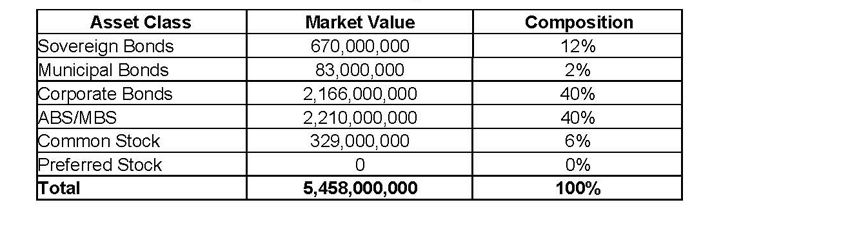

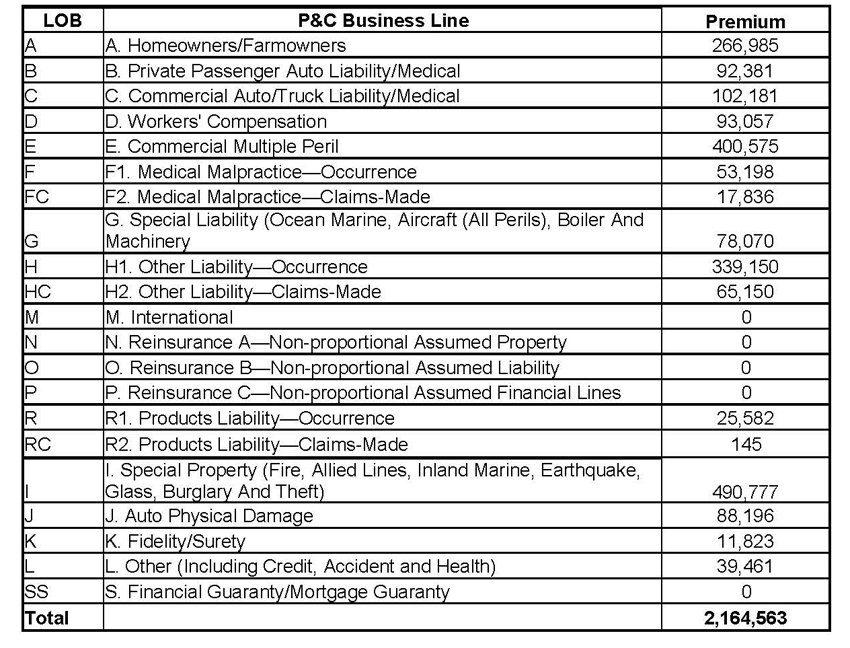

The following two tables summarize the investment portfolio of Cargo and its business lines:

Cargo's Investment Portfolio

Cargo's Line of Business

Our primary goals with this case study are to:

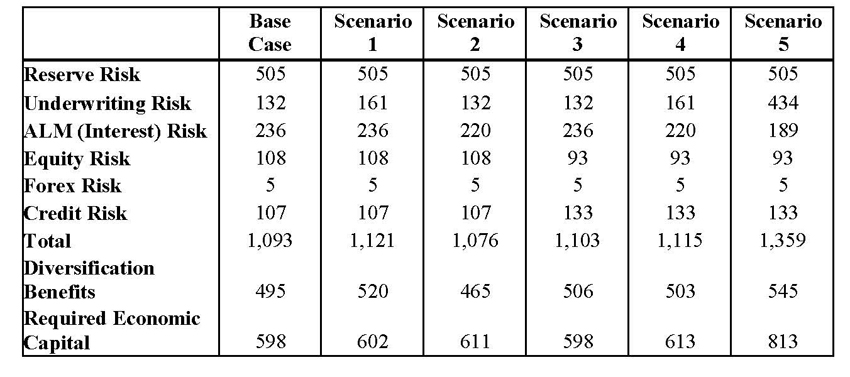

Seabury set up a Base Case assessment of Cargo’s risk with alternative scenarios to assess the impact that these particular scenarios would have on the company’s VaR:

The Base Case is intended to evaluate the risk and return of Cargo under conditions as close to the business climate as has prevailed for the last 10 years as possible. In other words, the base case should reflect management’s view of the firm’s required capital in the ordinary course, or steady- state. Each of the subsequent scenarios is intended to simulate a condition that management believes has a probability of occurring. How high of a probability is a matter that will be discussed later.

The objectives of the ERM analysis should be to determine if the company has: 1) enough economic capital to support its business activities at a specified level of statistical confidence through a variety of adverse economic scenarios; 2) to develop an understanding of the company’s downside risk, i.e., the chance probability of losing a certain amount of its capital in any one year; 3) to ensure that capital is allocated to business activities in proportion their respective risk contributions; and 4) to ensure that the rate of return on capital for each business activity is understood.

Management should know the answer to each one of these questions for each business strategy that it undertakes. Each business strategy should also be stress-tested. In this way, the risk and return of different strategies can be compared.

Four Principal Drivers of Economic Capital

The authors believe that there are four principal drivers of the amount of economic capital that companies should carry:

The amount of capital that is required given a company’s VaR at a specified level of statistical confidence. The statistical confidence results from the model’s data parameterization period. Steady-state capital does not capture rare market events. To capture this issue, management needs to perform stress-tests.

The authors define operational risk capital as the capital that is required to support losses that result from a company’s failed internal processes, such as losses that result from a failure to draft contracts tightly; losses that result from systems failures, etc.

The amount of capital that is required to sustain a company through severe market dislocations and volatility, also known as market events. We may know these events by names such as: October 1987, The Asian Crisis of 1997, or the equity market crash of 2001. The point is that these events are often not represented in the historical data parameters of the enterprise risk model—any model has this limitation. As such, these events need to be imposed on the model in order to learn what their impact would be on the company given the particular structure of its assets and liabilities.

The amount of capital that is required by a company to safely absorb losses that result from its catastrophe exposures.

Risks Omitted from this Case Study

It is important to say at the very beginning that this case study will not attempt to evaluate the risk capital that will be required to support Cargo’s operational or catastrophe risk (other than what has been captured in the last 10 years of the paid loss triangles). The principal purpose of this exercise is to reveal the dynamics of measuring integrated risk with those fields of information that are available to us on a robust basis from publicly available sources. This includes: interest rate risk, credit risk, foreign exchange, and insurance risk (non-catastrophe). Reliable figures on operational and catastrophe risk are not readily available from any source other than the company itself. Therefore, the economic capital assessments and allocations that are made in this exercise may appear low due to the omission of these two factors. Seabury’s ERM engine does possess the ability to readily integrate and aggregate a company’s operating risk and catastrophe distributions with that of the rest of its risk so that a total solution is realized. The principal issue that we are attempting to illustrate in this case study is how economic capital is impacted within an integrated framework, from a base case realization to that of various stress-tests.

Operational Risk Capital

The difficulty of quantifying operational risk is that there are no public databases that record and classify these events such as there are for most of the other categories of risk—interest rate risk, credit risk, paid losses, etc. As such, the first thing that any company will discover as it implements an integrated enterprise risk management system is that the economic capital requirement will often be significantly less than the company’s actual capital level (nominal capital). The difference between companies’ nominal capital and economic capital should generally be attributed to three sources of risk: 1) Operational risk, 2) Catastrophe risk, and 3) Market Event risk.

We have identified catastrophe risk as well as what the grab-bag of operational risks may consist. Market events, and the capital required to support them, can be described as those events that occur in the market whose expectation may fall outside the model’s historical data parameters. For example, Seabury’s ERM is parameterized with 10 years of data for both assets and liabilities for which we obtain annual updates. This means that Seabury’s ERM utilizes historical probabilities of the events that have occurred over the last 10 years. The resulting VaR represents a company’s risk given that events during this historical time period are as equally likely to occur over the next year as they were over any one of the previous 10 years.

Should we assume that Cargo has sufficient capital if its nominal capital exceeds its economic capital? To answer this, we would have to ask ourselves if the financial and insurance markets might experience an event during the next year that was without precedent in the last 10 years. If so, we would want to include a scenario that reflected the potential for that event; be it a market movement like that of October of 1987, the Asian Crisis of 1997, or the equity market crash of 2001. This is why we create scenario analysis and stress-tests. This is also why companies’ nominal capital will generally exceed, by some significant margin, their economic capital requirements as measured within an ERM context. The drafters of risk-based capital for such regulatory initiatives as Basel II and Solvency II have debated and openly speculated as to which multiplier of the 99% VaR economic capital should be imposed on the insurance and the banking industries to account for this limitation. Since this risk parameter is unknowable, risk managers often prefer to implement scenario analysis and stress testing to arrive at their best estimate of required capital. For this exercise on Cargo, we are not including calculating the capital requirements for operational or catastrophe risk requirements, only that risk resulting from steady-state conditions and that risk resulting from various scenarios and market events.

Cargo's Risk

In table 1 below, we display the results of Cargo’s risks by category and scenario. Risks are displayed in dollars (millions).

Table 1

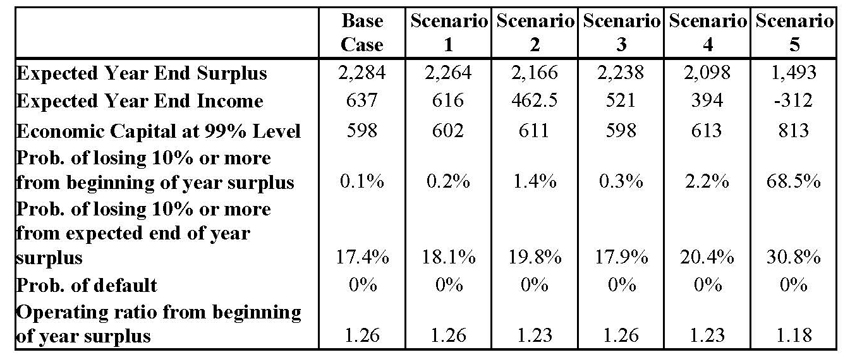

To be able to make any assessments about the company’s capital adequacy, we need to examine the company’s expected year end surplus in comparison to its required level of capital at the 99% confidence level. We can observe this in Table 2 below.

Table 2

Table 2 reveals the impact of each scenario to several critical measures of economic capital and income. For the most part, it appears that Cargo has enough economic capital to sustain it through all of the scenarios although Scenario 5 has a serious impact. Table 2 includes some entries that have not yet been defined:

Expected Year End Surplus: This represents the amount of surplus that ERM predicts that Cargo will have at the end of the year and includes adjustments that result from: retained earnings (pre tax), capital gains/losses, unrealized gains/losses, and changes to reserves.

Expected Year End Income: This represents the earnings that ERM predicts Cargo will be able to recognize at year end and includes adjustments resulting from: capital gains/losses, unrealized gains/losses, and changes to reserves. Note: The definition of income in the ERM framework is equivalent to that of net worth (i.e., impact to surplus), not distributable earnings.

Probability of losing 10% or more from beginning-of-year/end-of-year surplus: This represents the probability that the company will lose at least 10% or more of its capital from its beginning-of- year/end-of-year surplus level. This is also known as the company’s downside risk. ERM assesses this probability for any percent of the firm’s surplus.

Key insights from ERM analysis of Cargo:

What can the CEO of Cargo say to his board of directors about their company’s overall risk and financial performance based on this analysis?

What the CEO actually says to his board will depend, in large part, on how large a probability his advisors will assign to Scenarios 4 and 5 since this is where both economic capital and earnings get hit the hardest. The CEO will have to review how significant an event it would be for Cargo to lose 20% of its capital since the probability of this occurrence increases to 45.4% in scenario 5. To be clear, the analysis is not saying that there is a 45.4% chance that Cargo will lose 20% or more of its capital, it is saying that this is only likely in the event of Scenario 5—and Scenario 5 may only have a 5% chance of occurring. There is no way of attributing the likelihood of a market “event” unless that event is contained in the model’s data history. Assigning weights to low probability scenarios is beyond the scope of what an ERM system can provide if the events are not in the model’s historical parameters. However, an integrated ERM can provide the user with a good assessment of the likely impact if the event does occur.

Why are Scenarios and Stress Testing Important?

Stress testing is a process of identifying, often through Monte Carlo Simulations, the response of an asset or liability portfolio (or both), to a variety of types of financial distress. The purpose of the stress test is to evaluate how the organization whose portfolio is being tested would fare under a specific set of adverse market conditions. In the absence of being able to identify how many times 99% VaR capital should be imposed, risk managers will often identify specific market crises as being the events for which they want their institution to be prepared. These events, and their demonstrated ability to survive them without impairment, become a part of what they represent to the world as their statement of solidity. For this reason, ERM has been provided with a robust scenario generating capability. As a result, the ERM user can use an ERM system in two ways: 1) to observe their economic capital requirements at a desired level of VaR confidence assuming the business and economic climate does not deviate substantially from steady-state; or 2) the user can stress test market events that may have low expectations of occurrence—perhaps as low as once in 50 years for financial risk or once in 500 years for catastrophe risk. Many companies have found it useful to think in these terms rather than establishing a multiple of steady-state capital as the desirable level of capital to hold.

Cargo’s management team will want to run a large variety of single and stacked (simultaneous) scenarios that reflect their judgment about potential market events. They will then want to position their company to be able to withstand a level of risk that is in concert with their and the board’s collective judgment about acceptable risk. To be able to do this, Cargo will need an integrated ERM that is fast enough to be able to provide results in real time and simple enough that complex risk interactions are revealed in easy-to-digest output. Cargo’s management may want to increase capitalization by about 36% if it wants to maintain the same downside risk probabilities in Scenario 5, as it currently enjoys in the Base Case. The countervailing judgment would have to be: how disadvantageous would this level of capitalization be to the company’s current market competitiveness? This is the balance that management must strike.

Capital Allocation and RAROC at Cargo

ERM allocates economic and stand-alone capital allocations to Cargo’s regulatory operating segments. Several lines require negative capital due to the diversification effect. Nominal capital has been allocated in proportion to that of Economic Capital and overhead has been allocated to each LOB in proportion to its premium volume (since specific overhead allocations are not available to the authors). RAROC for individual lines has been calculated based on stand-alone risk. Most of the individual segments appear to be making adequate RAROC values.

Table 3