Interest Rate Risk

Cash flows generated by ERM are discounted in accordance with the

term structure of interest rates. ERM simulates individual interest rates for a specified set of

maturities and captures both parallel and non-parallel shifts in the yield curve. Interest rate

risk is incurred when there is a mismatch between the company’s assets and liabilities. The

mismatched income is subject to the interest rate risk of the specific time bucket in which it

occurs. Cash flows are assigned to time buckets (vertices) in accordance with the

RiskMetrics methodology that is covered in the next section.

-

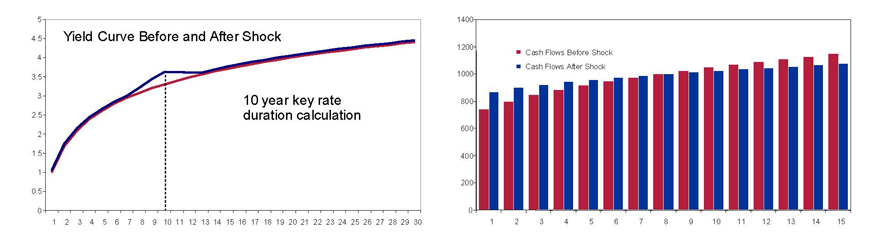

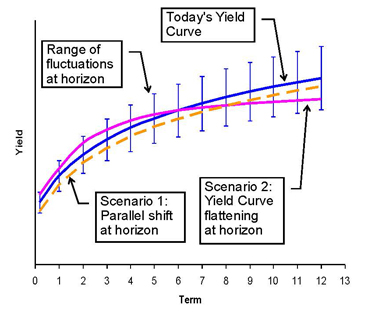

Duration measures the average mismatch risk in cash flows and only immunizes against parallel shifts in the

yield curve.

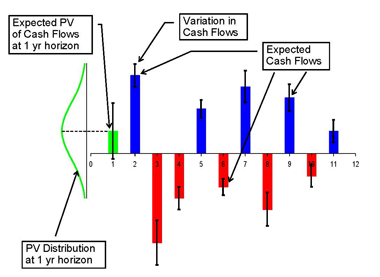

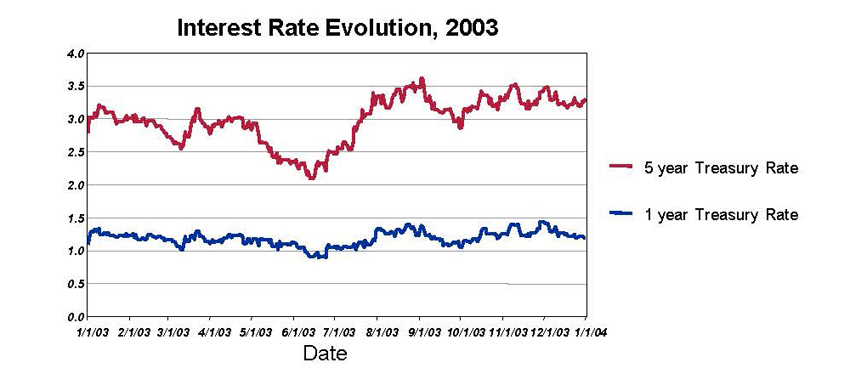

- The yield curve is prone to more complicated fluctuations. Mismatches in any year create exposure to interest

rate fluctuations.

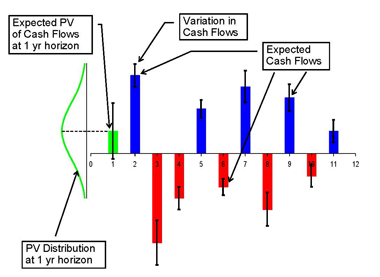

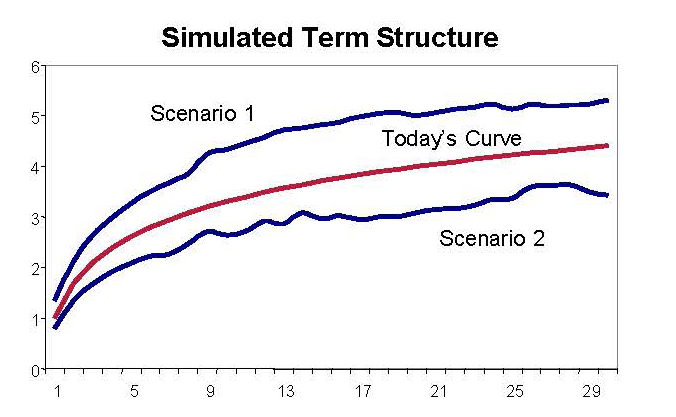

- ERM calculates the actual cash flows for each year and finds their present value for each scenario. This results

in a distribution of the net PV relative to movements in the yield curve.

- Diversification Benefit = Net Risk – Sum (Annual Bucket Risks)

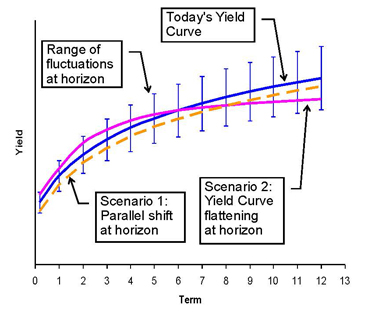

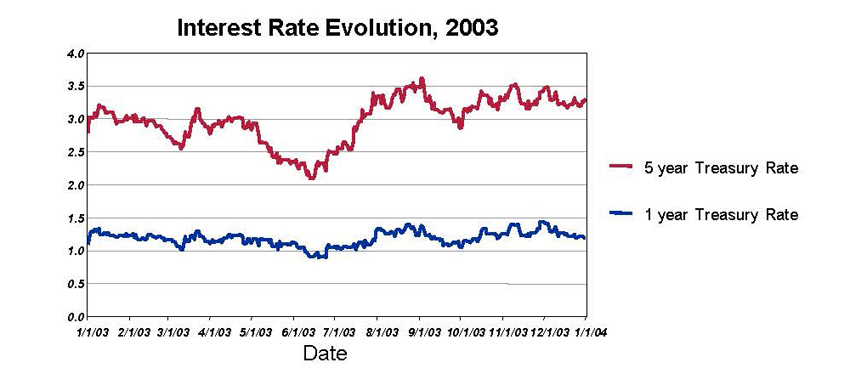

Yield curves follow complicated paths and non-parallel shifts. Therefore, duration is not adequate as a measure to capture this risk.

-

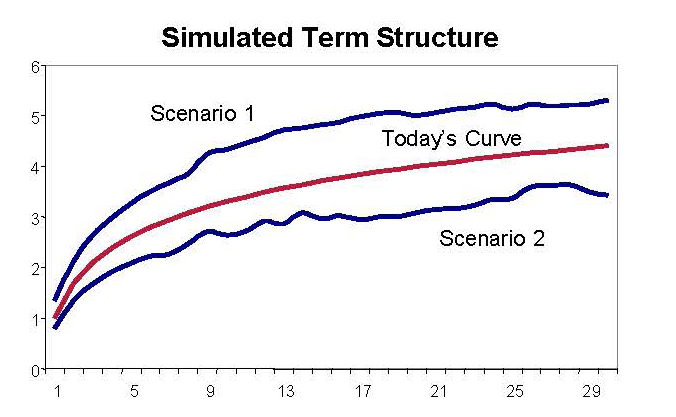

ERM simulates interest rates r1y , r2y ,…, r30y for each scenario preserving correlations

- Volatilities and correlations of interest rates are determined from the historical bond prices

- As a result, ERM produces new yield curves for each scenario

- Highly structured instruments like MBS/CMO/ABS make up to 30% of insurance portfolio holdings

- Most of these instruments incorporate embedded options, which depend on cash flow structures and

prepayment projections

- The embedded options are too complex to be evaluated directly in ERM in a short time (simulations are

required for each ERM scenario)

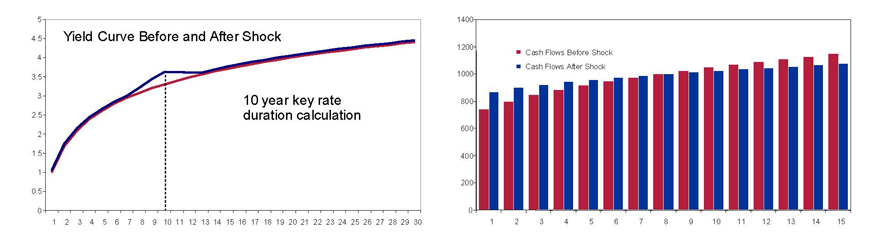

- ERM uses an approximation – key rate durations (KRD)/convexities method, which is accurate and fast

- KRD is a sensitivity of present value to the change in interest rate for a specific maturity

- Unlike modified duration where cash flows are assumed to be static, key rate durations capture changes in

projected cash flows as well as in discount factors

- ERM applies KRD for each maturity (1 year, 2 years, … , 30 years)

- ERM uses pre-calculated KRD from the third-party vendors of market data and fixed-income analytics