Beyond Business Intelligence

Predictive Science for Today's Bottom Line

Beyond Business Intelligence

Predictive Science for Today's Bottom Line

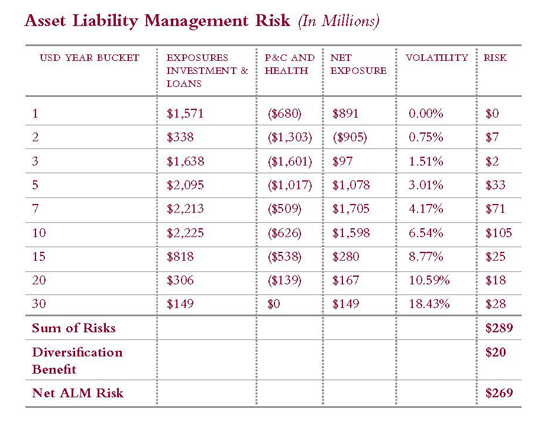

Interest rate risk is the uncertainty associated with a change in interest rates. It measures a change in the net value of fixed income instruments and insurance liabilities resulting from the potential fluctuations in interest rates. In most cases, variations in future interest rates impact present value through the adjustment of discounting factors. But for some instruments like callable bonds or ABS/MBS, changing interest rates may impact the projected cash flows. Predyct ERM estimates interest rate risk parameters from the historical variations in government yield curves. Interest rate risk translates into Asset Liability Management when cash flows (inflows - outflows = net cash flow at risk) are bucketed by maturity and subject to a change in value due to a change in interest rates. Predyct ERM simulates these cash inflows and outflows by maturity to assess the value differential between assets and liabilities by all maturities as depicted in the below exhibit.